Navigating the current economic landscape due to COVID-19 can be difficult for small business owners. Fortunately, a lifeline is available—the Employee Retention Tax Credit (ERTC). If you retained employees in their jobs during the tumultuous pandemic, you may qualify.

In this post, we will explain the benefits of ERTC and its eligibility requirements so your business can maximize its benefits.

Key Takeaways

- The Employee Retention Credit is a refundable business tax credit designed to provide financial relief due to the COVID-19 pandemic.

- Eligibility criteria and maximum credits vary depending on the year, with rules in place to avoid double-dipping benefits from other relief programs.

- Businesses should keep accurate records, regularly review eligibility criteria when claiming ERTC, and seek help from tax professionals such as the DASG team for the best results.

Understanding the Employee Retention Tax Credit

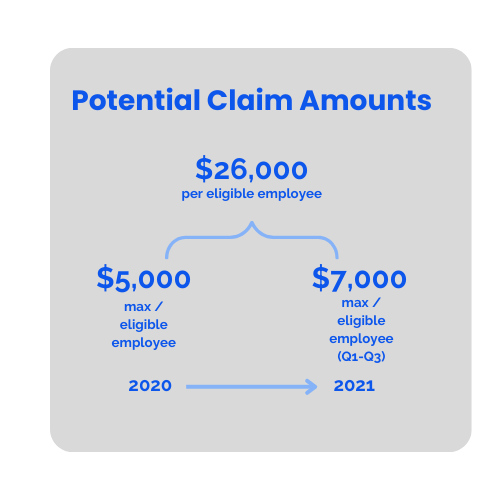

The ERTC is a refundable tax credit that can provide up to $26,000 per employee for eligible businesses requiring financial aid during the COVID-19 pandemic. It offers distinct criteria and amounts depending on which year it’s applied to, making this an attractive option for many companies looking at their bottom line.

Knowing what exactly the ERTC has to offer and how it could potentially benefit your business should be considered when determining your tax strategies. Eligibility requirements must be met by businesses seeking relief from this helpful resource designed specifically with them in mind!

What is the employee retention credit?

The Employee Retention Tax Credit is an important government relief program to assist companies affected by COVID-19. The credit offers a refundable tax break for eligible businesses, allowing them to receive support regarding wages paid and associated healthcare costs, enabling their ability to keep employees on board during these difficult times.

This incentive calculates qualified wages as a percentage when deciding how much money businesses may get back through this valuable employee retention tool, acting as a useful means of keeping afloat throughout the pandemic period without too much worry about finances.

The Evolution of ERTC

The ERTC, initially established in March 2020 through the Coronavirus Aid, Relief and Economic Security Act (CARES), has since been amended three times to offer a tax relief. These modifications of eligibility requirements, maximum credits available, and how they interact with other assistance programs came from various legislative acts such as the Consolidated Appropriations Act and the American Rescue Plan Act.

A noteworthy change is that those who had received Paycheck Protection Program (PPP) loans now have access to claim the benefit offered by this program, too, provided they do not use up similar wages for both reliefs. The amendment granted via 2021’s Consolidations Appropriation Bill enabled businesses to make optimum use of these two supportive measures despite being disallowed earlier on.

Key Features of ERTC

The ERTC offers a tax credit that can be reclaimed depending on the wages of those who qualify. The requirements to receive this rebate differ from year to year. For instance, in 2020, eligible businesses could apply up to $5,000 per worker; in 2021, it was raised to $7,000 each quarter for every staff member.

Various other relief programs interconnected with the ERTC, like the Paycheck Protection Program (PPP) or Shuttered Venue Operators Grant (SVOG), have rules set up so that taking advantage of both isn’t possible.

How to Determine Your Business’s Eligibility for ERTC

To be eligible for the ERTC, you need to determine if your business qualifies. This includes factors such as the number of employees, any income decreases, and how government shutdowns during the pandemic affected operations.

Who qualifies for the employee retention tax credit?

Most businesses with W-2 employees, including colleges, universities, hospitals, and 501(c) organizations that have gone through a reduction in income or were affected by restrictions due to government regulations, may be qualified for the Employee Retention Credit. Previously, the Consolidated Appropriations Act expanded qualifications to include businesses that took a loan under the Paycheck Protection Program (PPP), including borrowers from the initial PPP round who were originally ineligible to claim the tax credit.

Qualification is determined by one of these factors for eligible employers — and one of these factors must apply in the calendar quarter the employer wishes to utilize the credit:

- Revenue Decline: For the 2020 tax year, a decrease in gross receipts can be determined when they are less than 50% of what was earned during the same period in 2019. During 2021’s first three quarters, a significant dip is expected compared to their respective calendar quarter from two years prior – with figures potentially dropping by more than 80%. Companies that do not see a 20% drop may use another consecutive month for assessment instead, providing an alternative method to calculate losses.

- Government Shutdown Impact: When exploring if an employer is eligible for the Employee Retention Credit, a key factor to consider is if their business had been mandated by government authorities to shut down or reduce its operations due solely to COVID-19. If this proves true, only wages paid out during the shutdown period can be deemed qualified wages, which are used in determining ERTC eligibility. It’s essential that every individual situation of potentially eligible employers should be taken into consideration separately when calculating these figures.

- Recovery Startup Business: To be designated as a Recovery Startup Business, the following criteria must be met:

- The business must have commenced its trade or operations after February 15, 2020.

- The entity must have annual gross receipts not exceeding $1 million.

- The business must not qualify for the Employee Retention Tax Credit (ERTC) under the other two established categories, namely, partial or full suspension of operations or a decline in gross receipts.

Per IRS Notice 2021-49, Recovery Startup Businesses can utilize all qualified wages to claim the credit, irrespective of their employee count. It is imperative to note that eligibility for this category is evaluated every quarter. Therefore, if a business qualifies under one of the other two categories—either a decline in gross receipts or partial/full suspension of operations—for the third quarter but not the fourth, it would be ineligible as a Recovery Startup Business for the third quarter. However, it may regain eligibility for the fourth quarter.

Understanding IRS Notice 2021-49 is crucial for implementing the requisite amendments to Form 941, which is necessary for claiming the credit. For retroactive claims on the applicable quarter(s) in which qualified wages were disbursed, Form 941-X should be utilized.

Calculating the Employee Retention Credit

Once you have established that your business meets the criteria for the ERTC, it is important to compute the tax credit. This involves factoring in qualified wages and health-related expenses and understanding what constitutes a maximum eligible amount of credit. Let us explore each element more closely.

Qualified Wages and Health Expenses

For companies with more than 100 full-time workers, only qualified wages paid to employees who cannot work due to coronavirus-related circumstances are eligible for the Employee Retention Credit (ERTC). For firms with fewer than 100 full-time staff members, though, all employee remuneration, including salaries given under the Families First Coronavirus Response Act (FFCRA), is covered by this credit. This includes any health plan expenses incurred by employers, too.

Maximum Credit Amounts

You need to know the maximum credit amounts to get the most out of your Employee Retention Credit. In 2020, businesses were allowed up to $5,000 per employee. This increased in 2021 with a maximum credit amount of $7,000 each quarter for every staff member. Keeping informed on these limits can ensure you gain all potential benefits from employee retention credits.

How does employee retention credit affect your tax return?

The Employee Retention Credit has the potential to be quite beneficial for your business when filing taxes. By reducing payroll tax liability, you may even receive an amount back in return as part of your refund. This could provide much-needed financial aid during these difficult times while helping maintain employment opportunities for your firm’s employees.

Claiming the Employee Retention Credit

To take advantage of the ERTC, filing Form 941-X with the Internal Revenue Service is necessary.

Consulting with one of the tax experts at DASG can help guarantee accuracy and adherence to any associated rules or regulations. We will look into how to submit this form in detail for your business, providing expert guidance for you.

Filing Form 941-X

Form 941-X is a way to make the most out of the ERTC. With this form, you can claim back taxes that could’ve been missed from previously filed returns, providing an opportunity even after passing on it initially. With Form 941-X, any errors or mistakes found can be amended before submitting these changes towards eligible periods to get your full reimbursement amount of earned credits due without delay.

Working with a Tax Professional

DASG tax professionals can help you comprehend the complicated elements of the Employee Retention Credit and provide a comprehensive understanding of applicable laws. They can also guarantee accuracy in claiming your credits, guide you in gathering necessary documents, and assist you in complying with IRS norms while filing for ERTC. We can help reduce errors or omissions that may arise during the calculation and reporting of these credits.

Interaction with Other Relief Programs

The ERTC has several rules in place to stop double-dipping benefits and works alongside other relief programs, such as the Paycheck Protection Program (PPP) and the Shuttered Venue Operators Grant (SVOG). We will explore how these interact with one another. These restrictions ensure that no individual or company receives more than what is allocated by each program individually.

PPP and ERTC

Businesses can use the PPP and ERTC, but not for the same payroll expenses. However, wages that are higher than what is provided in a forgiven PPP loan amount may be used as qualified wages to benefit from ERC. This allows businesses to gain aid through two separate relief programs without double claiming those expenditures.

SVOG and ERTC

Those businesses who are given the Shuttered Venue Operators Grant (SVOG) must remember that payroll costs should not be used for ERTC. That way, they won’t get double assistance from both programs. To ensure companies can benefit to their fullest potential while still adhering to rules and regulations, it’s important not to mix these two types of grants together.

Retroactive Application of Employee Retention Credit

No need to worry if you missed your chance of claiming the ERTC on time. It’s still possible to do so retrospectively. Simply submit an application before the deadline, extend it, or amend past returns accordingly. Let us explore these options in more detail now.

Deadlines and Extensions

It’s essential to recognize the deadlines for filing amended returns and extensions related to retroactive applications of ERTC, as these may differ depending on the year or laws in place. For instance, you have until April 15th, 2025, to file any correct amendment regarding a qualified business claim made within 2021 quarters. Similarly, if amending prior-year Q2 through Q4, returns from 2020 must be completed by April 2024 at the latest. Comprehending these timeframes is key if businesses want to miss out on taking advantage of this tax credit when applicable periods arise.

Amending Past Returns

Businesses can file an amended federal income tax return or use Form 941-X to take advantage of the ERTC for any periods they may have missed out on. Amending past returns allows you to reap all applicable benefits and ensure no valuable credits go unused. Ultimately, this is a great way to ensure maximum benefit from taxation laws and regulations.

The DASG tax professionals can analyze past returns with you to determine eligibility.

Tips for Maximizing Your Employee Retention Credit

Staying on top of your records and verifying qualification requirements are key to ensuring you get the most out of ERTC. We’re here to advise utilizing these benefits to maximize them within your organization.

Accurate Record-Keeping

Accurate documentation is essential to being eligible for the Employee Retention Credit (ERTC). Such records provide information regarding wages paid, health expenses, and other relevant aspects that can be used to qualify for maximum credits.

Having complete and accurate disclosure records helps companies avoid potential audits or penalties for not following IRS regulations. Proper record-keeping ensures that employees receive all possible benefits available through their retention tax credit claim process.

Reviewing Eligibility Criteria

To get the most out of the ERTC, it’s necessary to keep up with changes in eligibility requirements. To ensure you are taking full advantage of this credit, continually review these criteria and work closely with a tax professional for Guidance. Keeping informed on alterations can help maximize your benefits from this opportunity.

Next steps: Getting help with your Employee Retention Credit

DASG has specialized services to assist with achieving a successful ERTC claiming experience. Our experts know the intricate details and will help you accurately calculate, report, and gather any necessary documentation to stay compliant with IRS regulations. With their assistance, businesses could make the most out of this tax credit during these difficult times. They offer great guidance throughout the process to guarantee its smooth operation from beginning to end.

Summary

The Employee Retention Credit is a great asset for businesses navigating the impacts of the global COVID-19 crisis and should not be overlooked by having a good understanding of ERTC eligibility requirements, being able to work out how much credit you can claim with your records, and seeking help from tax advisors when necessary.

Employers are in an advantageous position regarding retaining employees while obtaining financial support. Take advantage today and ensure this benefit does not slip through the cracks!

Frequently Asked Questions

How does the employee retention credit work?

Eligible employers may be able to claim a refundable Employee Retention Credit (ERC) in the form of tax credits against certain employment taxes. This credit is allocated at up to $7,000 per employee every quarter for a total yearly maximum of $28,000 and can come regardless of whether no income taxes were paid during 2020 or 2021, as it is based on payroll taxes instead. The ERC enables businesses with employees to benefit financially from their retention efforts over this period.

Who qualifies for an ERC refund?

To be eligible for an ERC refund, businesses must have experienced either a full or partial suspension of operations due to a governmental order related to COVID-19 or a significant decline in gross receipts compared to 2019.

Qualified wages must have been paid in 2020 and 2021 to take advantage of the tax credit.

Is Employee Retention Credit tax deductible?

The Employee Retention Credit allows businesses to apply it as a reduction of their payroll taxes, Decreasing the amount owed in tax liability. The benefit should be claimed for wages paid within that same year and deducted from those wages accordingly. Thus, employee retention costs can lead directly to some measure of financial savings at the corporate level through this credit program.

How has the ERTC evolved since its inception?

The Employee Retention Tax Credit (ERTC) was created in March 2020 to assist companies suffering financially from the pandemic’s effects. Three updates have been made since then, which permit businesses to postpone paying payroll taxes, receive tax credits on wages paid out, and take advantage of other related incentives. As such, it has become a life-saver for many firms that would otherwise struggle without this benefit. Wages given to personnel are also eligible forms of reimbursement due to this credit, making cash flow far easier during these hard times as payroll taxes can be pushed back more easily.

What is the maximum credit amount available for each employee under the ERTC in 2021?

Each employee can access up to $7,000 worth of credits quarterly under the Employee Retention Tax Credit (ERTC) program for 2021.